Crypto Coins Forecast Insights Into The Digital Future

Exploring the crypto coins forecast opens a window into the dynamic and ever-evolving world of digital currencies. With the rise of blockchain technology and growing interest from investors, understanding the various factors that influence crypto coin prices has never been more crucial.

From the diverse types of crypto coins available to the methods used for forecasting their future trends, this discussion will break down the essential elements that shape the landscape of cryptocurrency investing. We’ll dive into historical trends, expert opinions, investment strategies, and the regulatory impacts that create the current market environment.

Overview of Crypto Coins

Cryptocurrency has revolutionized the way we perceive money and transactions in the digital age. At its core, crypto coins represent a form of digital currency that utilizes cryptographic techniques to secure transactions, control the creation of additional units, and verify the transfer of assets. Their significance lies in their potential to facilitate peer-to-peer transactions without the need for intermediaries, making them a disruptive force in traditional finance.There are various types of crypto coins available in the market today.

These include major currencies like Bitcoin and Ethereum, stablecoins designed to maintain a stable value, and altcoins which offer different functionalities and purposes. The diversity in crypto coins allows investors to choose based on their risk tolerance and investment goals.

Types of Crypto Coins

- Bitcoin (BTC): The first and most well-known cryptocurrency, often seen as digital gold.

- Ethereum (ETH): Known for its smart contract functionality, allowing developers to build decentralized applications.

- Litecoin (LTC): Aimed at providing fast and low-cost transactions.

- Ripple (XRP): Focused on enabling real-time international money transfers.

- Stablecoins (e.g., USDT, USDC): Cryptocurrencies pegged to stable assets like the US dollar to reduce volatility.

| Crypto Coin | Market Capitalization (USD) | Primary Use |

|---|---|---|

| Bitcoin (BTC) | $800 Billion | Store of value, digital currency |

| Ethereum (ETH) | $400 Billion | Smart contracts, dApps |

| Litecoin (LTC) | $10 Billion | Peer-to-peer payments |

| Ripple (XRP) | $20 Billion | Cross-border payments |

| USDT (Tether) | $70 Billion | Stable value transactions |

Factors Influencing Crypto Coin Prices

Several factors play a pivotal role in determining the prices of crypto coins. Market dynamics, including supply and demand, can lead to significant price fluctuations. Additionally, external economic events, technological advancements, and regulatory news can sway investor sentiment and impact market prices.Market sentiment is a critical factor influencing price movements, as it reflects the general attitude of investors towards a particular cryptocurrency.

Positive news can drive prices up, while negative news can lead to quick sell-offs.

Key Economic Indicators

- Inflation rates

- Interest rates

- Stock market performance

- Global economic stability

- Regulatory announcements

Forecasting Techniques for Crypto Coins

Understanding how to predict crypto coin prices is crucial for successful investment. Various forecasting techniques can be employed, including fundamental and technical analysis. While fundamental analysis focuses on assessing the intrinsic value of a cryptocurrency through its technology, team, and market demand, technical analysis revolves around price movements and chart patterns.Technical analysis tools, such as moving averages and Relative Strength Index (RSI), can provide insights into price trends and potential reversals.

Traders often use these indicators to make informed decisions based on historical data.

Prediction Models

There are various models used in the crypto market for price predictions:

ARIMA (AutoRegressive Integrated Moving Average)

A statistical method that utilizes historical price data to forecast future prices based on identified patterns.

Machine Learning Algorithms

These models, such as neural networks, learn from vast datasets to identify trends and predict future price movements.

Sentiment Analysis Tools

These leverage social media and news trends to gauge public sentiment and its potential impact on coin prices.

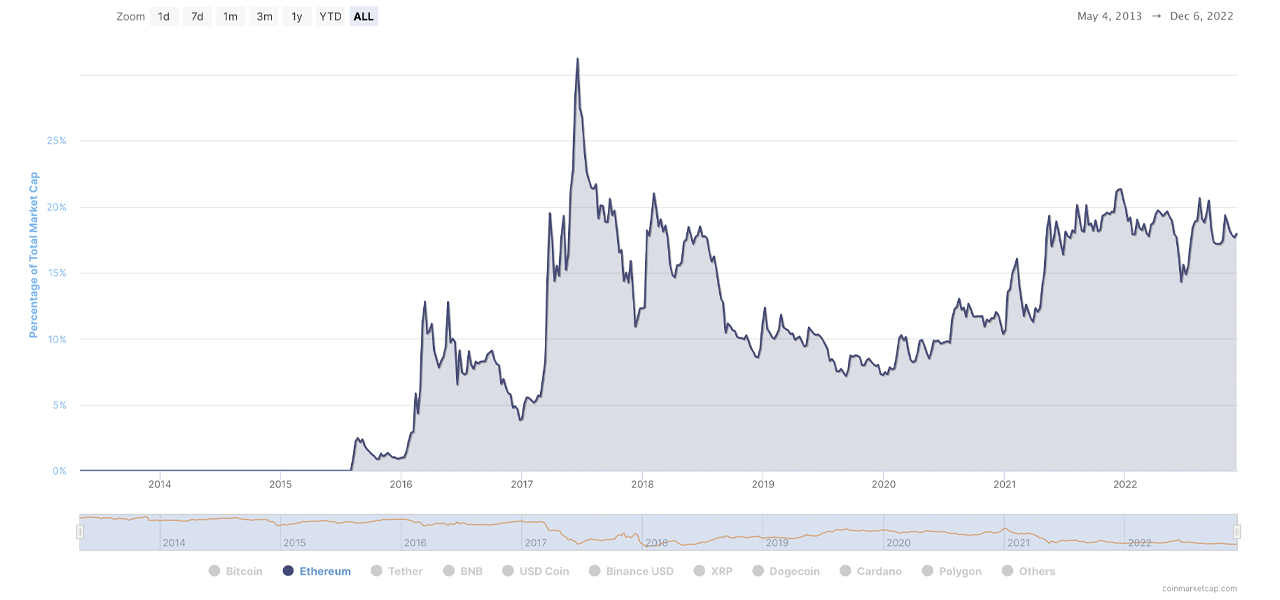

Historical Trends in Crypto Coin Prices

Examining historical price trends is essential for understanding the crypto market's volatility. Major cryptocurrencies like Bitcoin and Ethereum have experienced significant price swings, influenced by various factors such as regulatory changes, technological advancements, and market adoption.Significant events include Bitcoin's rise to nearly $20,000 in December 2017, followed by a drastic decline. More recently, the surge in Ethereum's price during the DeFi boom in 2020 illustrates how market conditions can create rapid changes.

Timeline of Major Crypto Events

| Date | Event Description | Bitcoin Price Change ||--------------|-----------------------------------------|------------------------|| Dec 2017 | Bitcoin reaches $20,000 | +1,900% from 2016 || Jan 2018 | Market correction begins | -65% in 3 months || May 2020 | Bitcoin halving event | +300% in 6 months || Feb 2021 | Tesla invests $1.5 billion in Bitcoin | +50% in 1 month || Dec 2021 | Bitcoin hits an all-time high above $69,000 | +300% from Jan 2021 |

Expert Opinions on Future Crypto Coin Trends

Industry experts continue to share insights regarding the future of crypto coins. Many believe that the growing acceptance of cryptocurrencies by financial institutions and corporations will drive mass adoption. Furthermore, as technological advancements unfold, the utility of crypto coins is expected to expand.Recent reports suggest a bullish outlook for major cryptocurrencies, as analysts project further growth in 2023 and beyond.

The integration of crypto assets into traditional finance could further solidify their importance in the global economy.

Notable Quotes

“Cryptocurrencies are here to stay and will inevitably find their place in the financial ecosystem.”

Industry Expert

“The future of finance is decentralized, and crypto coins are leading the charge.”

Financial Analyst

Investment Strategies for Crypto Coins

Investing in crypto coins requires a clear strategy to navigate the volatile market. Various strategies can be adopted, from day trading to long-term holding. Each approach comes with its own set of risks and potential rewards.Short-term strategies often involve trading based on market fluctuations and trends, while long-term strategies focus on holding assets through market cycles. Understanding the risks associated with each approach is crucial for investors.

Comparison of Investment Strategies

| Strategy Type | Risk Level | Potential Rewards |

|---|---|---|

| Short-term Trading | High | Quick profits from market fluctuations |

| Long-term Holding | Moderate | Benefit from overall market growth |

| Dollar-Cost Averaging | Low | Reduced impact of volatility |

Regulatory Impacts on Crypto Coin Forecasts

Government regulations play a significant role in shaping the crypto landscape. Regulatory frameworks can either foster growth or impose restrictions on the market. Recent changes, such as increased scrutiny on exchanges and initial coin offerings (ICOs), have made investors more cautious.Countries like China have imposed strict regulations, leading to major shifts in the market, while regions like the European Union are working towards creating a comprehensive regulatory framework to support innovation.

Examples of Notable Regulations

- United States: Ongoing discussions on cryptocurrency regulation and tax implications.

- China: Crackdown on crypto trading and mining operations.

- European Union: Proposals for comprehensive regulations to support crypto innovation.

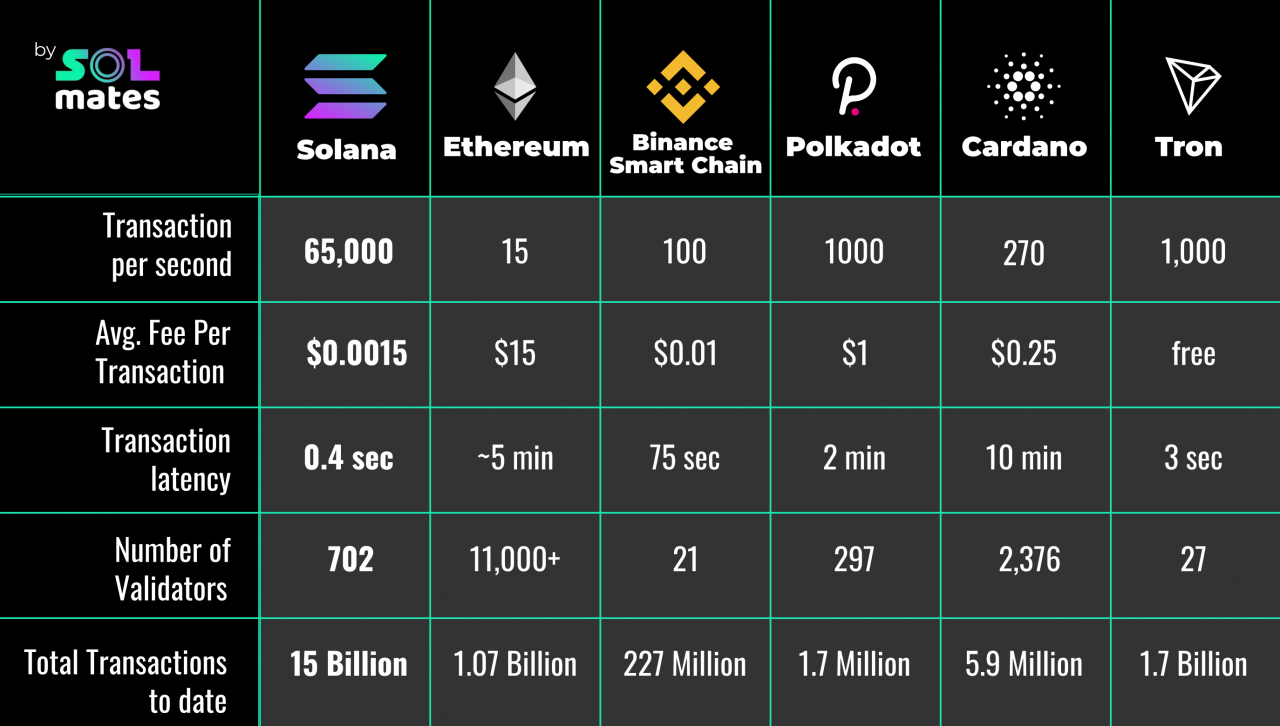

Technological Advances and Their Influence

Technological advancements are continuously reshaping the crypto landscape. Innovations in blockchain technology, such as scalability solutions and interoperability, are essential for the growth of cryptocurrencies.Blockchain technology remains at the heart of crypto coins, enabling secure and transparent transactions. Emerging technologies, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), are also creating new markets and opportunities for investment.

Emerging Technologies

- Layer 2 solutions (e.g., Lightning Network)

- Interoperability protocols (e.g., Polkadot)

- Decentralized finance platforms (e.g., Uniswap)

- Non-fungible tokens (NFTs) and their applications

Last Recap

In summary, navigating the world of crypto coins requires a solid understanding of market dynamics and emerging trends. As we look to the future, the insights gathered from historical data, expert predictions, and technological advancements will be vital for both seasoned investors and newcomers alike. Keeping abreast of these developments can help you make informed decisions in the fast-paced crypto market.

FAQ Resource

What are crypto coins?

Crypto coins are digital currencies that utilize cryptography for security and operate on decentralized networks, primarily based on blockchain technology.

How are crypto coin prices determined?

Prices are influenced by supply and demand dynamics, market sentiment, regulatory developments, and economic indicators.

What forecasting methods are used for crypto coins?

Common methods include technical analysis, sentiment analysis, and machine learning models that predict price trends based on historical data.

What are the risks of investing in crypto coins?

Investing in crypto coins can be risky due to market volatility, regulatory uncertainty, and the potential for loss of funds through hacking or scams.

How do regulations impact crypto coin forecasting?

Regulations can affect market stability and investor confidence, influencing price movements and the overall growth of crypto markets.